Selecting the Right Singapore Payroll Services to Enhance Your Business Operations

Wiki Article

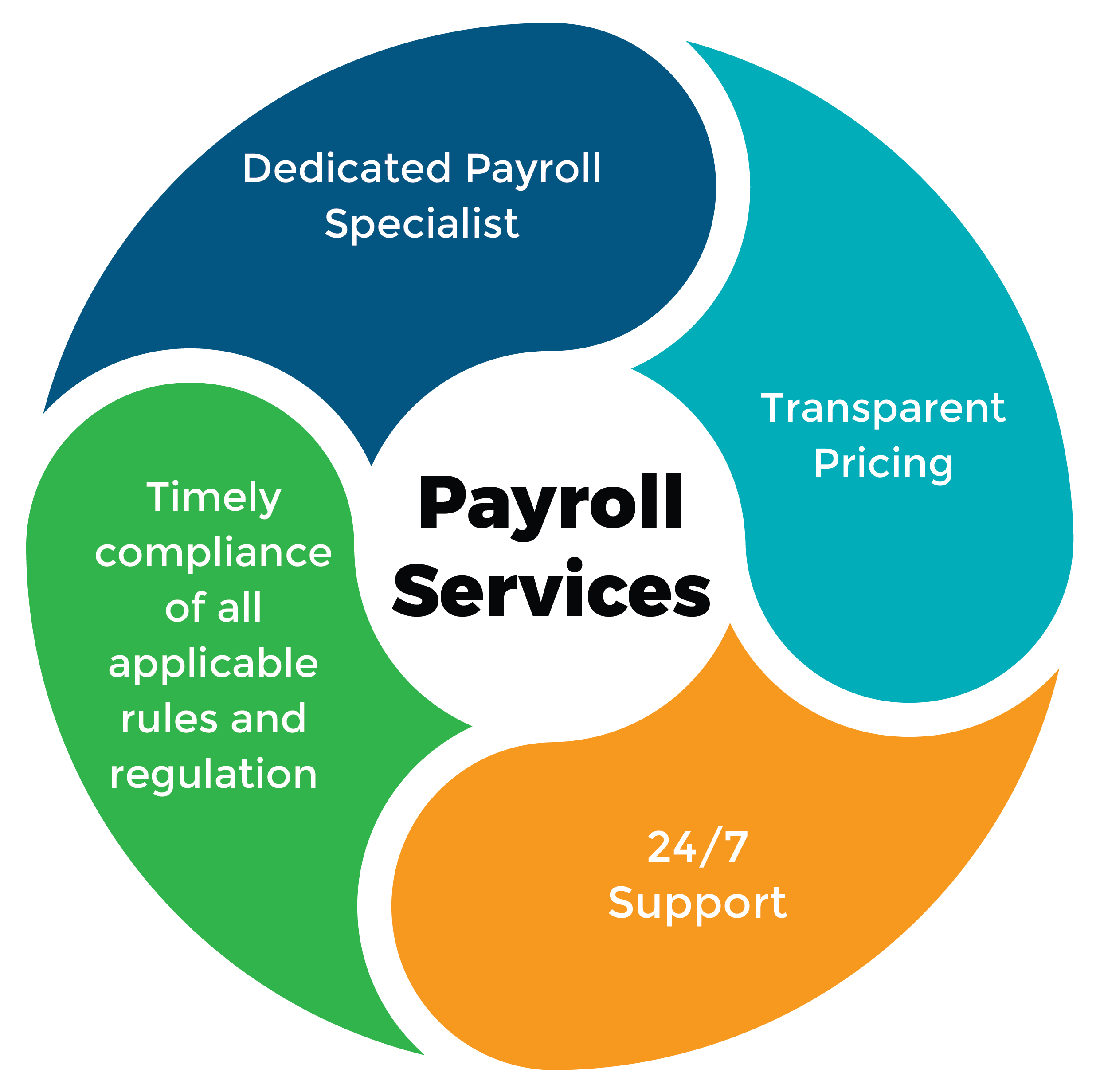

Simplifying Your Company Operations: The Trick Perks of Outsourcing Payroll Services

In the realm of modern-day business procedures, the intricacies of managing pay-roll can typically become a substantial worry for business of all sizes. The choice to outsource pay-roll services has actually become a tactical solution accepted by many companies looking for to improve their operations. By delegating this important facet of monetary management to external specialists, services can unlock a variety of benefits that not just relieve administrative burdens however also pave the means for improved efficiency and conformity. The true degree of benefits that contracting out pay-roll services can provide goes past plain convenience, hinting at a transformative capacity that holds the crucial to maximizing company processes.Cost Financial Savings

One of the main advantages of outsourcing pay-roll solutions is the potential for significant cost savings for businesses. By leaving payroll tasks to a specialized third-party supplier, business can minimize the requirement for in-house staff dedicated to payroll processing, hence decreasing labor prices - Singapore Payroll Services. Furthermore, contracting out removes the necessity of spending in pricey pay-roll software application and innovation framework, which can result in substantial financial savings for organizations of all dimensionsFurthermore, outsourcing payroll services can aid minimize the danger of costly errors in pay-roll handling. Professional pay-roll company have the know-how and innovation to make sure exact and timely payroll estimations, tax filings, and conformity with laws. By preventing penalties and charges connected with pay-roll errors, businesses can better save cash in the future.

Boosted Compliance

Ensuring governing adherence and meeting lawful obligations is an essential facet of outsourcing pay-roll services. By handing over payroll responsibilities to a specialized third-party service provider, businesses can take advantage of boosted compliance with ever-evolving tax regulations, labor laws, and reporting requirements. Expert payroll company remain current with the most recent adjustments in regulation, lowering the threat of costly charges arising from non-compliance.

Outsourcing pay-roll solutions can aid companies browse intricate tax codes, wage regulations, and fringe benefit policies a lot more effectively. Carriers have the knowledge to make certain exact tax calculations, timely filing of returns, and correct paperwork, minimizing the possibility for mistakes that can lead to fines or lawful problems. Additionally, they can supply assistance on conformity issues, such as wage garnishments, overtime policies, and legal reductions, aiding organizations keep a legitimately audio pay-roll procedure.

Time Efficiency

Turning over pay-roll obligations to a specialized third-party carrier not just boosts conformity with governing requirements but additionally substantially improves the moment performance of managing payroll processes. Time efficiency is an important facet of pay-roll administration, as it directly impacts the total performance and emphasis of a business. By contracting out pay-roll services, companies can conserve useful time that would otherwise be Check Out Your URL invested in tedious administrative jobs such as determining wages, refining pay-roll taxes, and generating records.Outsourcing payroll permits organizations to enhance their operations by unloading lengthy payroll jobs to professionals that are skilled in payroll procedures and policies. This enables interior staff to devote their energy and time to even more critical and revenue-generating tasks, eventually driving business development (Singapore Payroll Services). Outsourcing payroll solutions can lead to faster processing times, timely pay-roll delivery, and lowered errors, all of which contribute to raised time effectiveness within the company.

Improved Accuracy

Accomplishing accuracy in payroll handling is crucial for companies seeking to boost financial openness and governing compliance. By outsourcing pay-roll solutions, companies can dramatically improve the accuracy of their monetary documents. Specialist pay-roll provider have the expertise and technology to decrease mistakes in refining employee tax obligations, advantages, and wages. These specialists are skilled in the complicated regulations and tax legislations that regulate pay-roll, minimizing the threat of pricey blunders.

Better precision in payroll processing not just enhances monetary reporting but additionally promotes count on amongst employees. Employees depend on getting precise and prompt settlement, and outsourcing payroll solutions can assist companies meet these assumptions regularly. Overall, the accuracy acquired via outsourcing payroll services can lead to raised operational performance and decreased compliance look at this site risks for companies.

Access to Experience

With outsourcing pay-roll solutions, organizations gain access to customized competence in browsing intricate pay-roll laws and tax obligation regulations. Pay-roll solution suppliers have committed groups with a deep understanding of the ever-changing landscape of pay-roll conformity.

In addition, pay-roll company frequently have experience collaborating with companies across various industries. This exposure outfits them with a broad point of view on different payroll practices and obstacles, permitting them to use useful insights and ideal techniques customized to your certain needs. Whether it's managing multi-state payroll, managing fringe benefit, or making sure precise tax filings, contracting out payroll services gives accessibility to a riches of competence that can aid enhance operations and alleviate potential risks. Inevitably, leveraging the knowledge of payroll professionals can result in increased efficiency and compliance for your business.

Verdict

To conclude, contracting out payroll solutions provides substantial benefits for organizations, consisting of price savings, improved conformity, time effectiveness, boosted accuracy, and accessibility to experience. By enhancing business operations via outsourcing, organizations can concentrate on core tasks and tactical campaigns, leading to improved overall performance and profitability. This calculated choice can help services remain affordable in today's dynamic market landscape.By outsourcing pay-roll solutions, companies can save useful time that would certainly otherwise be spent on tedious management tasks such as determining earnings, refining pay-roll taxes, and generating reports.

Contracting out payroll enables organizations to streamline their operations by offloading lengthy pay-roll jobs to specialists who are well-versed in payroll processes and guidelines. Contracting out pay-roll solutions can lead to faster handling times, prompt pay-roll distribution, and decreased errors, all of which add to boosted time performance within the company.

With contracting out pay-roll solutions, services gain access to specialized expertise in navigating complex payroll regulations and tax laws. Whether it's managing multi-state pay-roll, taking care of worker advantages, or making certain exact tax obligation filings, contracting out payroll services supplies accessibility to a riches of competence that can assist enhance operations and reduce potential risks.

Report this wiki page